How much should logistics matter to online retail platforms?

Plenty, says Goizueta’s Ruomeng Cui. In fact, forward-thinking organizations would do well to factor logistics into the integral design of their strategy.

And that’s because, according to her new research, the ability to deliver products to customers in a manner that is both timely and efficient has a direct and significant impact on revenue and retention rates.

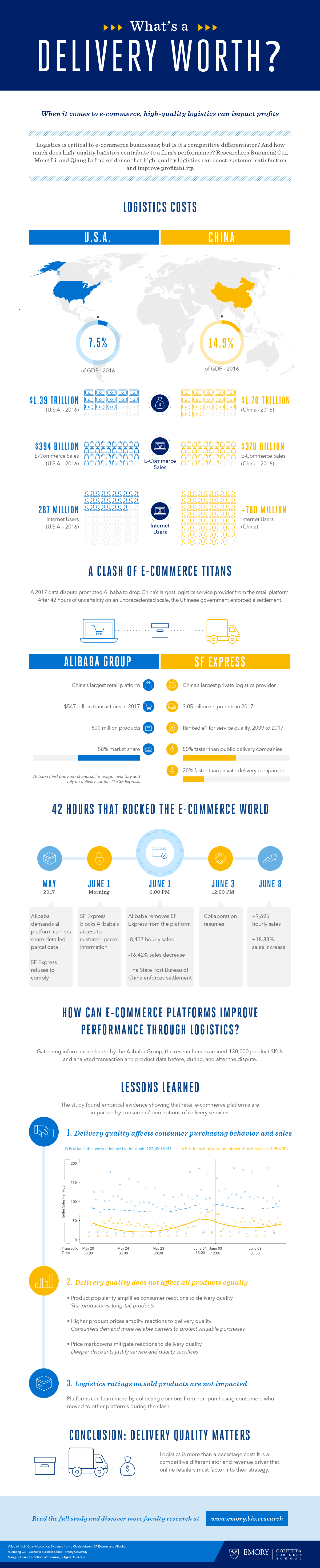

Together with Rutgers’ Meng Li and Qiang Li, Cui who is Assistant Professor of Information Systems and Operation Management, has analyzed huge quantities of data from a clash between e-commerce behemoth, Alibaba, and China’s largest logistics firm, SF Express in June 2017.

Differences between the companies led to Alibaba suspending SF services for a period of 48 hours between June 1 and June 3, 2017. The financial fallout from the dispute was impressive – much greater than Cui and her co-authors had hypothesized. Alibaba sales fell by a stunning 16.42 percent during the course of the SF Express outage and picked up again by 18.83 percent when normal services were resumed.

And these findings have implications for all businesses operating in the e-commerce space, says Cui.

“Alibaba is the world’s largest online retail platform. Its activities dwarf that of its nearest rival, Amazon,” she said. “We were able to exploit this unique event in 2017 to gain real insight into the economic value of logistics to the biggest e-commerce entity on the planet, so in that sense, our findings have relevance for anyone operating in this space.”

Going into the study, says Cui, she and her colleagues had expected to find “some negative impact on sales” as a result of the dispute. They were, in fact, stunned by the “magnitude” of customer reaction.

“The study also provides insight into how customers value logistics as an integral function of the online shopping experience. We figured that if you remove the best logistics option, then some –but not all – of your customers are going to care. And we hypothesized that this might play out in the Alibaba scenario through a downtick of maybe 3 or 5 percent in sales. At more than 10 percent, the magnitude of the actual response was honestly surprising.”

Using a public data set provided by Alibaba, the researchers sifted more than 1 million transactions attached to 130,000 stock keeping units (SKUs) across China, between June 1 and 3, 2017. Because only a relatively small proportion of goods were affected by the SF Express dispute, they were able to isolate, compare and contrast data from this group with sales data across other, unaffected products.

Breaking down their findings, the researchers found that the withdrawal of SF Express from the Alibaba platform had a more deleterious effect on in-demand or “star” products, on expensive products and on products that were not discounted than on marked-down or long-tail goods.”

“This stands to reason,” says Cui. “Customers will turn to competing retail platforms for the star products, just as they will expect expensive goods to be delivered in a reliable manner to protect them from damages or loss. Conversely, with cheaper or discounted SUKs, customers are willing to sacrifice the service in exchange for a bargain or a price markdown.”

Significantly, Cui and her colleagues found that the SF Express clash had relatively little impact on Alibaba customer logistics ratings – a finding that calls into question the reliability of these ratings as a metrics mechanism.

“Giving logistics services a rating is essentially an ex-post activity,” explains Cui. “In other words, customers evaluate a product or service after they have received it. In the Alibaba case, the customers affected by the logistics dispute don’t make the purchase – they’ve already left the platform and won’t bother to evaluate the service. They’re lost customers. So this rating is no longer relevant as a metric.”

With the ongoing crisis in bricks and mortar retail, e-commerce is a market continues to pick up momentum. Cui argues that logistics should be prioritized in the online retail context.

“Customers search, compare and place an order online. Delivery is, therefore, a critical component of the customer life cycle; it’s where they get to receive the physical product and experience the service for the first. Until now, quantifying the value of logistics quality on retail platforms has been almost impossible, because it’s just too costly for companies to manipulate the service quality at the company or platform level at the risk of losing billions of dollars. The Alibaba case demonstrates that not only do logistics matter – they are a competitive differentiator. I’d go further and say that logistics should inform operations strategy as a front-stage revenue driver that companies should proactively compete over.”

A number of companies, Amazon included, are now exploring the option of integrating or in-sourcing logistics in the effort to improve delivery quality. And this is potentially a very good practice, says Cui. She also recommends that online retailers explore the advantages of pursuing a long-tail strategy in their product offerings as a shield against competition from direct service.

“Retail platforms should also evaluate their product characteristics – whether they are star products, luxury or long tail – and consider tailoring the delivery to the product. But essentially, whatever tactic a firm opts to pursue, the key takeaway is that logistics and operations strategy are much more than a backstage cost. They are a critical competitive differentiator that should be integrated into your organization’s strategy.”

Visualizing the Research